Due to the prevalence of cell phone and tablet use, mobile giving is gaining in popularity. After all, it requires little effort on the donor’s end; support is just a tap away and can be done from anywhere!

In this guide, we’ll cover all of the bases of mobile giving and how to make the most of it through the following topics:

- What Is Mobile Giving?

- Types of Mobile Giving

- Text-to-Donate Trends

- Benefits of Mobile Giving

- How To Start a Mobile Giving Campaign

- Mobile Giving Best Practices

- Examples of Text-to-Donate Campaigns

- Snowball’s Mobile Giving Platform

We’ll unpack everything you need to know about mobile giving from vocabulary to future projections. It’s a crucial aspect of any nonprofit organization’s fundraising strategy, especially in the digital age. Let’s jump in.

What Is Mobile Giving?

Mobile giving refers to donors using their phones and tablets to give to nonprofits, churches, and other organizations they care about. This way of contributing funds is becoming increasingly relevant as smartphones allow donors to give from anywhere, at any time.

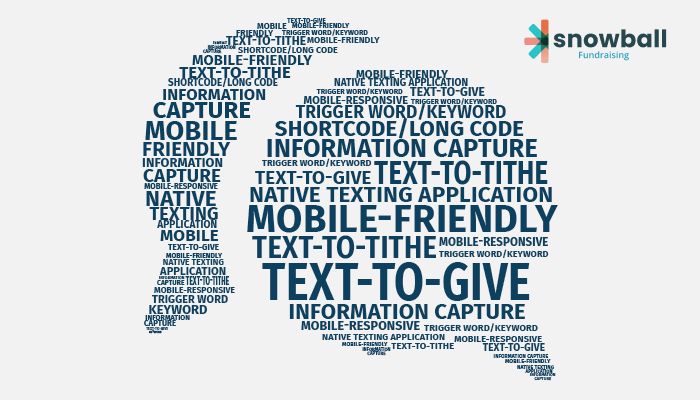

If you’ve never heard of this type of fundraising, there are a few terms that you’ll need to know before you can start leveraging mobile giving. Explore these key vocabulary terms:

- Mobile-friendly: Mobile-friendly refers to how content comes across on a smartphone or tablet. Mobile-friendly pages are visually appealing and fit within the confines of a mobile device’s screen, providing an easy user experience.

- Mobile-responsive: Mobile-responsive donation pages are forms that look and function well on smartphones, tablets, and other mobile devices. These pages are typically designed with larger buttons and are set up vertically as opposed to horizontally.

- Native texting application: Native texting apps are the text messaging portals that come standard on a person’s phone. For example, iPhones provide iMessage for texting capabilities. This is important in reference to mobile giving because organizations can send fundraising appeals and donation links in texts for easy mobile giving.

- Text-to-donate: At its most basic level, text-to-donate is a type of mobile giving that involves donors texting a donation amount to a nonprofit’s number directly from the native texting app on their phones.

- Text-to-tithe: Another name for text-to-donate, text-to-tithe is a term commonly used by churches that promote text-to-donate during their services and events. Despite the name, text-to-tithe can be used by religious organizations to collect not only tithes but also offerings and other charitable gifts.

- Information capture: When donors use mobile giving to contribute to nonprofits, they must input certain information for the donation to be processed. Nonprofits can use their mobile giving platforms to capture data such as names, phone numbers, email addresses, billing addresses, and engagement history.

- Short code/Long code: Short codes and long codes each refer to a type of mobile giving phone number an organization might be assigned when they register with a text-to-donate platform. Short codes are 5-6 digit numbers that donors can use from anywhere in the nation. They’re used to facilitate app-to-person communication. On the other hand, long codes are traditional phone numbers. Unique to each person, they consist of 10 digits that start with an area code.

- Trigger word/Keyword: Also known as a keyword, a trigger word is an easy-to-remember word or phrase that donors can type into their phones and send as a text to trigger a link to their phones. An example of a trigger word would be ‘GIVE’ or the name of your organization.

Mobile giving is steadily rising in popularity and has cemented itself as a fundraising strategy here to stay! Let’s take a closer look at the different types of mobile giving.

Types of Mobile Giving

Mobile giving encompasses four types of fundraisers, which each require unique planning and execution to become part of your nonprofit’s fundraising strategy. Consider each of the following mobile fundraisers.

Text-to-Donate

Text-to-donate involves donors texting a donation amount and keyword to a number set up by the nonprofit organization. Here’s how it works:

- Your organization promotes its specific number and keyword.

- Donors text the keyword to your number to send a specified amount.

- Your organization receives the amount.

It’s as easy as that! In just a few simple steps, your nonprofit receives the funding it needs to fulfill its mission.

Mobile Fundraising Pages

Your nonprofit may already have an online donation page, but mobile giving takes digital fundraising a step further by making it accessible to mobile devices. Mobile fundraising pages are donation portals made to work well on smartphones, tablets, and other mobile devices.

Here, supporters can take action by donating to your cause from any device. Whether they sign up for recurring gifts of $5 or submit a one-time major gift, they can do it all from their phones with mobile-friendly form fields, optimized design elements, and more.

Email Fundraising

Marketers who use segmented email campaigns witness nearly a 760% increase in their revenues. With 54% of nonprofit email messages opened on mobile devices, there is a huge advantage to offering donors a way to give through their mobile inboxes.

Mobile email campaigns use compelling visuals and mission-driven content to drive supporters to mobile fundraising pages. This way, you can present donors with an easy way to give from one of their preferred channels of communication.

Mobile Giving Apps

Mobile giving apps enable organizations to design branded donation pages that donors can give through after downloading the app on their mobile devices. After creating a mobile giving app, nonprofits can share the download link across their promotional channels to encourage supporters to get the application on their smartphones and tablets. Once donors have access to the app, they can quickly contribute gifts via the app’s donation page as often as they’d like.

Text-to-Donate Trends

It’s no mystery that mobile giving is an increasingly popular fundraising strategy. Here are some factors contributing to the popularity of text-to-donate and the insights we can draw from these statistics:

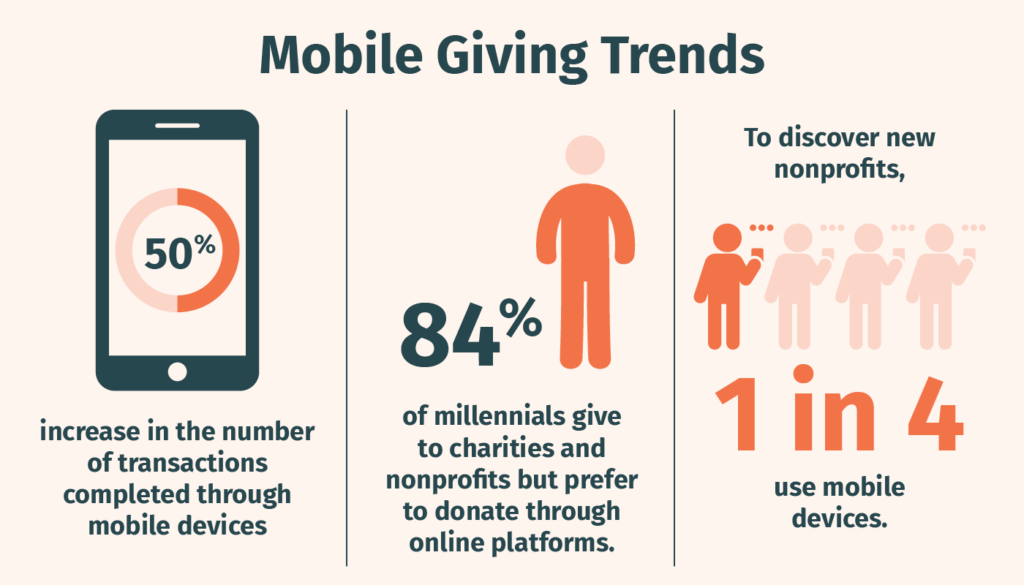

- There has been a 50% increase in the number of transactions completed through mobile devices. Mobile giving is becoming increasingly popular and will continue to grow as the technology becomes more standardized.

- 84% of millennials give to charities and nonprofits but prefer to donate through online platforms. Nearly an entire demographic sees the value in mobile giving, and future generations will follow suit as its popularity expands.

- To discover new nonprofits, 1 in 4 donors use mobile devices. This means mobile fundraising can help new supporters find your nonprofit, even if they were previously unaware of your organization.

As mobile device usage increases, it’s clear that mobile fundraising is the future of charitable giving. In fact, Millennials and Generation Z are some of mobile giving’s primary demographics. Seeing as they’re the next generation of donors and mobile fundraising is their preferred giving channel, promoting this innovative giving method will allow you to secure the support you need for decades to come!

Benefits of Mobile Giving

Mobile fundraising is not only beneficial for nonprofits, but streamlines giving for donors as well. Let’s walk through how nonprofits and donors both benefit from mobile giving.

Mobile Giving Benefits For Nonprofits

Aside from increased fundraising potential, nonprofits can also receive the following benefits from mobile giving:

- Valuable data insights: Mobile giving provides your nonprofit with an additional way to measure donors’ giving habits, which can help you choose the best communication channels, craft target appeals, and connect more deeply with supporters.

- Cost-effective fundraising: Mobile fundraising is easy to implement, especially with self-sustaining methods like text-to-donate. This saves your nonprofit important staff time and allows you to collect donations by simply marketing your fundraiser.

- Increased donor retention: Successful donor retention is built on effective communication. Consistent interactions strengthen the bond between your nonprofit and its supporters, which mobile giving can enhance by saving card information and encouraging recurring gifts.

To access these benefits, all your nonprofit needs to do is implement mobile giving into its fundraising strategy. As your organization collects increased donations, donors will also become more engaged with your fundraising efforts.

Mobile Giving Benefits For Donors

Donors can benefit in the following ways from mobile giving:

- Ease-of-use: Mobile giving reaches donors where they already are, making it convenient for them to give to your nonprofit. Plus, mobile giving technology relies on platforms that donors are already familiar with, such as text and email. Because they won’t have to learn a new technology to participate in mobile giving, donors can get set up quickly and easily.

- Secure payments: Donors can rest assured that their payment information is safe when your nonprofit leverages PCI-compliant tools to accept mobile donations.

- Accessible giving: Many mobile giving platforms offer increased accessibility for all of your various donors. This makes mobile giving methods like text-to-donate more widely available to the largest audiences possible.

Equipped with a convenient and secure giving process, donors will be more eager to give to your cause.

How To Start a Mobile Giving Campaign

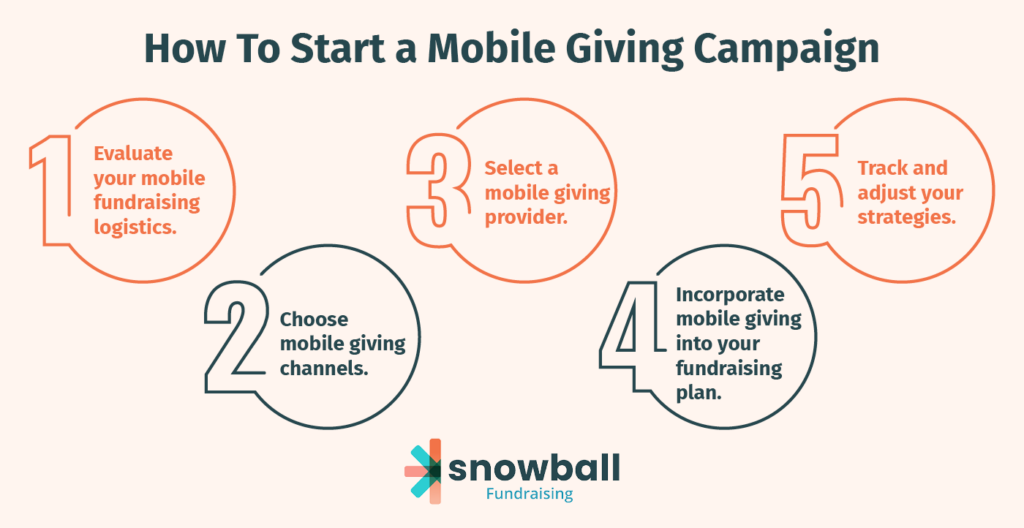

In five simple steps, your organization can plan and implement a successful mobile giving campaign to help meet your fundraising goals.

1. Evaluate your mobile fundraising logistics.

Introducing a new fundraising channel requires a reallocation of your organization’s resources. Prepare for your text-to-donate campaign by carefully planning logistics, such as:

- Which of your staff member(s) will oversee this strategy

- What you’ll be using the new platform for

- What the timeline will be for implementing mobile giving

- How you’ll let donors know about your new giving channel(s)

With a solid plan in hand, your organization will be ready to incorporate mobile giving into your fundraising plan.

2. Choose mobile giving channels.

Not every mobile giving channel is right for every nonprofit. It’s important to know which strategies you can easily implement and which ones your donors will most positively respond to.

To determine which channels work best for your organization, consider the following:

- What existing online/mobile fundraising strategies do you have in place? If you already have an online donation page, it might be easier to start with mobile-responsive donation forms than a mobile giving app.

- What channels have your donors expressed interest in? Poll your supporters and ask them what they think. You can send out an email survey to get opinions from your donors and plan accordingly.

Remember, you don’t have to just choose one mobile giving channel. There are a whole host of options to pick from. Find what works best for your organization and your donors.

3. Select a mobile giving provider.

Once you know exactly which mobile giving channels you’ll be using, look for a mobile giving provider whose services align with your needs. For example, you might want a text-to-donate provider that offers unlimited inbound text messages.

To identify the right provider, ask the following questions:

- What is our budget?

- What do available providers offer?

- How will this platform integrate with our other software?

- What platforms best suit the needs of our donors?

- Will we need training and support?

Use your responses to guide your search and narrow down your list of potential providers. Anytime you bring new technology into the mix, you have to be proactive about selecting your organization’s best fit.

Don’t just focus on the now. Look for a scalable mobile giving platform with the capacity to grow with your organization.

4. Incorporate mobile giving into your fundraising plan.

Most mobile giving campaigns, like text-to-donate, are meant to be used in conjunction with your other fundraising strategies. For example, you might decide to:

- Promote text-to-donate at your annual fundraising event.

- Let direct mail donors know that they can give via your mobile-responsive donation page.

- Encourage new donors to try out your mobile giving app by mentioning it in your welcome email.

The most successful nonprofits recognize the value of letting their various fundraising techniques inform one another. Be sure to use the data gathered through your mobile giving technology to learn more about donors’ giving habits.

5. Track and adjust your strategies.

To maximize your mobile giving results, it’s important to keep track of your campaigns and goals. Monitor some key performance metrics (KPIs) such as:

- Average donation size

- Donation frequency

- Donation growth over time

- Frequently used giving channels

- When donations are being made

As you’re executing your campaign, note which strategies are working and which aren’t. Over time, you should adjust and correct where necessary.

Mobile Giving Best Practices

Mobile giving, when done correctly, can be a significant source of donations for your mission. Here’s how to make it happen.

Partner with the right provider.

When setting up a mobile giving campaign, your nonprofit’s main focus will be on promoting the fundraiser. You won’t have to facilitate donations since supporters will send them in from their phones, but you will need mobile giving software you can trust.

Make sure you choose the right provider for your mobile giving campaign depending on your nonprofit’s needs. For example, if you’re launching a text-to-donate campaign alongside your fundraising auction, an all-in-one tool will best serve your various fundraising needs.

Offer different giving levels.

When a donor arrives on a mobile-responsive donation page, they might not know how much they should give to your nonprofit. Rather than leaving the gift amount as a blank field, provide donors with a listing of suggested giving levels.

Offering specific donation amounts adds to the mobile-friendliness of your page since tappable form fields are easier to use on mobile devices than manually typed responses. Also, by including giving levels within your donation pages, you can encourage donors to give within a specific range and help increase your average gift size.

Optimize your digital marketing strategy for mobile.

One of the best ways to launch and market your mobile giving campaign is to optimize your digital strategy. Promote your campaign via:

- Social media: Luckily, most social media platforms make it simple to integrate links to your mobile donation pages—just be sure to learn the key distinctions and optimize your tactics accordingly.

- Search engines: 95% of mobile organic search visits come from Google, making the search engine a great place to spread the word about your mobile giving campaign. Apply for Google’s Ad Grant to promote your donation page for free and drive more traffic to your nonprofit’s website.

- Text reminders: Promotional text messages are a great segue into text-to-donate campaigns specifically, but can be a convenient way to market any mobile giving initiative. Keep these messages short and actionable.

Don’t be afraid to promote mobile giving through other mediums, like direct mail or in-person at a fundraising event. Just remember that the easiest way for donors to get involved is to click on a link from a text message, email, or social media bio, making digital marketing a highly successful strategy.

Explain the mobile giving process to supporters.

Your supporters want to contribute to your mission. But to do so, they need to know how! It’s your responsibility to provide them with concise instructions for how to give.

Depending on how you reach your donors, tailor your explanation by:

- Providing verbal instructions at live events

- Including infographics in your emails

- Posting a how-to on social media

Campaigns such as text-to-donate are so straightforward that instructions should be easy to disperse. This step is often overlooked, but the simpler the process is, the more inclined people will be to contribute.

Craft emails with mobile in mind.

With 85% of users using smartphones to access email, your team should craft emails that:

- Display information vertically rather than horizontally.

- Feature larger text and fewer images.

- Load well on 3” by 5” screens.

- Don’t require zooming to read.

- Include clear calls-to-action.

- Incorporate easy-to-use email donation buttons.

If you keep these best practices in mind, you’re sure to see your email fundraising revenue increase significantly.

Pair mobile with offline strategies.

When paired correctly, mobile fundraising and offline strategies can do a world of good for your nonprofit, as you’ll reach a wider audience on their preferred platform.

For example, you can:

- Include the URL to your mobile-responsive donation page in your direct mail appeals.

- Send out a hardcopy newsletter with instructions for text-to-donate fundraising.

- Use a billboard to advertise your new mobile-giving app.

- Create t-shirts for your event staff with your nonprofit’s text-to-donate phone number on the front and back.

Mobile fundraising doesn’t have to exist in an online vacuum, so make the most out of your resources to spread the word effectively.

Include a clear call to action.

Your donors want to contribute to your cause, so let them know how they can help! Providing donors with a clear call to action in all of your mobile fundraising campaigns ensures that they’ll know exactly what the next steps are for donating. Display your call-to-action prominently so that when donors are ready to contribute, they can.

Incorporate multiple mobile giving options.

Some of your donors prefer text-to-donate campaigns. Others would rather access a mobile-responsive donation page.

The key to mobile giving is to offer something for everyone. Assess what giving channels your donors prefer and offer them those options.

Examples of Text-to-Donate Campaigns

Text-to-donate campaigns are not just easy and flexible, but they can be used by nearly any type of organization! Let’s take a look at a few examples of different text-to-donate campaigns.

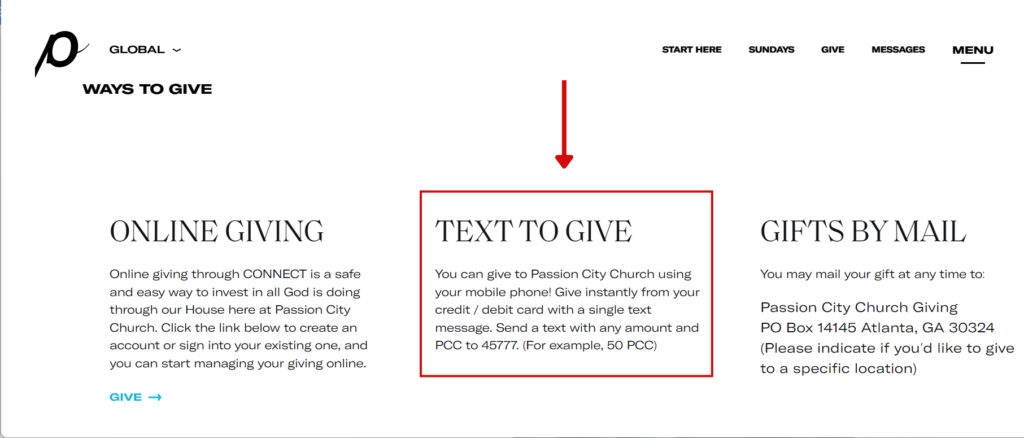

Churches

Churches sometimes leverage mobile giving technology to offer text-to-tithe capabilities to their congregation. Consider how Passion City Church presents text-to-donate on its website alongside other tithing options:

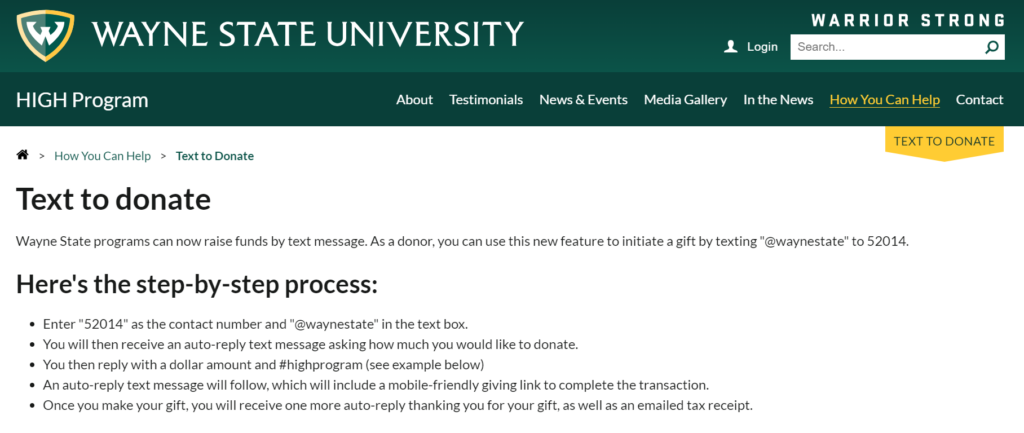

Universities

Institutions of higher education can also use text-to-donate to make the giving process easier for busy students or disengaged alumni. For example, check out Wayne State University’s text-to-donate page, which clearly outlines the process for potential donors.

Disaster Relief Organizations

Text-to-donate first became popular in 2010 with the viral Red Cross text-to-donate campaign for Haiti earthquake relief, bringing in millions. Now, the organization accepts text donations to support its Disaster Relief program:

![This image shows text-to-donate program information on the American Red Cross’s website.]](https://snowballfundraising.com/wp-content/uploads/2021/03/mobile-giving_example-2-1024x400.png)

Snowball’s Mobile Giving Platform

Snowball is an all-in-one online fundraising platform with several features that make giving on the go swift, simple, and secure.

These features include, but aren’t limited to:

- Text-to-donate technology

- Mobile and online giving portals

- Responsive fundraising thermometers

- Donor management systems

These solutions touch on just about every aspect of mobile giving out there. If you’re interested in a comprehensive answer to your mobile fundraising needs–look no further.

Not only does Snowball offer all of these services in one neat package, but we also have a unique spin on mobile giving that makes it even easier and more convenient than it already is. Unlike other services, Snowball allows that same donor to give through an email or mobile donation page without having to type in their credit card information all over again.

That information is securely stored in a safe, 3rd-party vault and tokenized to eliminate the risk of identity theft and fraud. Plus, donors also never have to create an account or remember a password.

Above all, it’s affordable! Our software features a free online donation page and a low-cost premium plan for text to give. With this host of benefits, Snowball’s mobile giving option can help your nonprofit organization reap the benefits highlighted throughout this guide.

Final Thoughts On Mobile Giving

Mobile giving is an essential tool for nonprofit organizations in the 21st century, as your donors are highly likely to be smartphone owners. Meet your supporters where they are and offer the most straightforward option for contributing funds! Besides, your organization will have a secure and easy method of fundraising in your toolkit.

- Virtual Fundraising Ideas: 60+ Campaigns for Online Success: Virtual fundraisers have the potential to increase mobile giving. With these ideas, your attendees don’t have to be geographically near your organization or event to give money to your cause.

- Boosting Conversion Rates: A Quick Guide for Nonprofits: To get more mobile donations, ensure that your donor journey provides an intuitive giving experience for your donors. This guide will help you evaluate your current strategy.

- Auction Software: What To Look For + 14 Provider Reviews: Ready to make your other fundraisers mobile? Learn how you can manage your auction with top-of-the-line software in this guide.

![Click this graphic to schedule a demo of Snowball’s mobile giving software.] [Link]](https://snowballfundraising.com/wp-content/uploads/2021/03/mobile-giving_cta-2-1024x439.png)